Streamlining the Life Insurance Process with AI-Powered Automation

Background

Buying or selling life insurance has long been a complex process filled with slow underwriting, fragmented documentation, and heavy administrative work. Pathwork, a life insurance technology company, is changing that reality.

By combining AI with deep industry expertise, Pathwork helps carriers and agents streamline underwriting, reduce paperwork, and accelerate every step of the insurance journey. The company’s mission is to remove friction from one of the most documentation-heavy industries and make the entire process faster, smarter, and more accurate.

Pathwork’s platform automates workflows across four major areas of the business, including underwriting, knowledge retrieval, and carrier-side operations. Its core products include:

- Case Underwriter – Automates the underwriting process by surfacing best-fit carrier options for insurance brokers within minutes.

- Knowledge Assistant – Acts as an on-demand expert, instantly answering questions about underwriting rules, product guidelines, and carrier nuances.

- Pre-App Manager– Helps insurance carriers more quickly evaluate cases, determine eligibility, and risk class.

Each of these products relies on transforming unstructured information such as medical records, PDFs, and underwriting guidelines into structured data that supports faster and more reliable decision-making.

“Our goal is to remove friction from one of the most paperwork-heavy industries,” says Blake Butterworth, Cofounder and CTO of Pathwork. “LlamaIndex helps us automate and scale that process with confidence.”

Challenge

Life insurance underwriting depends on massive volumes of complex, inconsistent documentation, including medical reports, lab results, and decades-old scanned PDFs.

Before integrating LlamaIndex, Pathwork’s internal system was reaching its limits. The team relied on a fragile, homegrown pipeline that broke PDFs into pages and passed them through OpenAI models. The process was slow, difficult to maintain, and prone to failure.

“We were hitting bottlenecks that directly limited customer growth,” Blake Butterworth, Cofounder and CTO of Pathwork, explains. “Documents were coming in faster than our systems could handle.”

About 60% of all underwriting cases include documentation, averaging 75 pages per case, with some extending to 1,000 pages. Many were low-quality scans from as far back as the 1970s, containing both text and images that legacy parsing tools could not handle accurately.

This created significant inefficiency, as valuable context remained trapped inside unstructured documents and slowed customer onboarding.

Solution

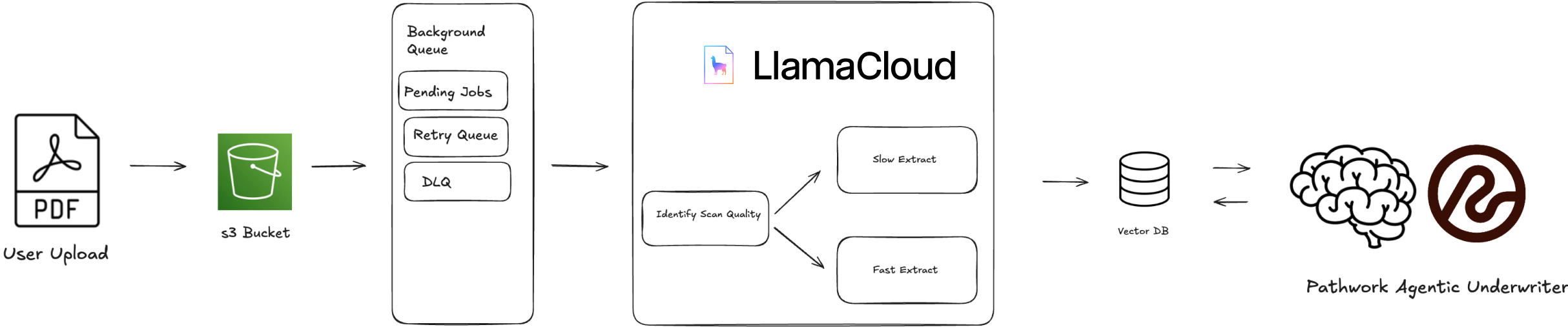

Pathwork integrated LlamaIndex to modernize its document processing and automate key workflows that had previously limited growth. The goal was simple: make unstructured data usable and scalable.

1. Document Processing for Underwriting: LlamaIndex became the foundation of Pathwork’s document ingestion pipeline. It now processes over 40,000 pages of medical documentation per week, converting scanned PDFs, handwritten notes, and image-heavy records into structured text that downstream models can analyze.

This shift replaced a fragile, manual process with a robust, automated pipeline capable of handling everything from high-quality digital forms to faded scans from the 1970s. As a result, Pathwork improved both throughput and accuracy while reducing time spent managing exceptions.

2. Carrier Underwriting Guidelines Extraction: LlamaIndex also powers Pathwork’s carrier guidelines automation. New regulatory updates and policy changes are now automatically parsed and indexed, allowing Pathwork’s RAG (retrieval-augmented generation) system to update risk rules and agent protocols in real time.

This automation eliminated the need for manual, hard-coded updates and ensured that underwriting logic stays current across all carriers.

“LlamaIndex helped us build a scalable, intelligent ingestion pipeline that understands documents, connects them to context, and keeps improving over time.” Ian Levinsky, CEO and CoFounder of Pathwork.

Impact

Integrating LlamaIndex unlocked new speed, stability, and scale for Pathwork’s platform. The team moved from a system limited by fragility to one built for growth.

Key outcomes:

- 8× increase in scale: Capacity grew from 5,000 to 40,000 documents per week, with no slowdown in performance.

- Higher reliability: Legacy bottlenecks and parsing errors were eliminated, stabilizing the ingestion pipeline.

- Improved accuracy: LlamaIndex’s parsing captured critical context from low-quality scans that text-only tools missed.

- Faster iteration: Engineers now spend less time maintaining code and more time building new product features.

- Future-proof infrastructure: Automatic model updates ensure continued improvements without manual rework.

“LlamaIndex didn’t just make our system faster, it made it sustainable,” says Ian, CEO and CoFounder of Pathwork. “Now we can scale without worrying about what’s breaking behind the scenes.”

With LlamaIndex as a core part of its infrastructure, Pathwork now operates with greater confidence and agility. The company continues to expand its product capabilities while maintaining high reliability, empowering insurers and agents to deliver faster, more accurate results to customers.

“LlamaIndex isn’t just a technology provider,” Blake adds. “They’re a partner that helps us move faster, automate smarter, and keep evolving.”